Features

Complete set of features for all your personal finance management needs.

Everything you need, from the most basic flows all the way to the most complex ones.

Transactions

Expenses

Simple, yet so Powerful

Expenses are the foundation of your personal finance management. CashControl allows you to easily add, edit and delete expenses, with categories, custom accounts and details.

You can manually enter your expenses, or import them from your bank account statements, with complete control on how to categorize them.

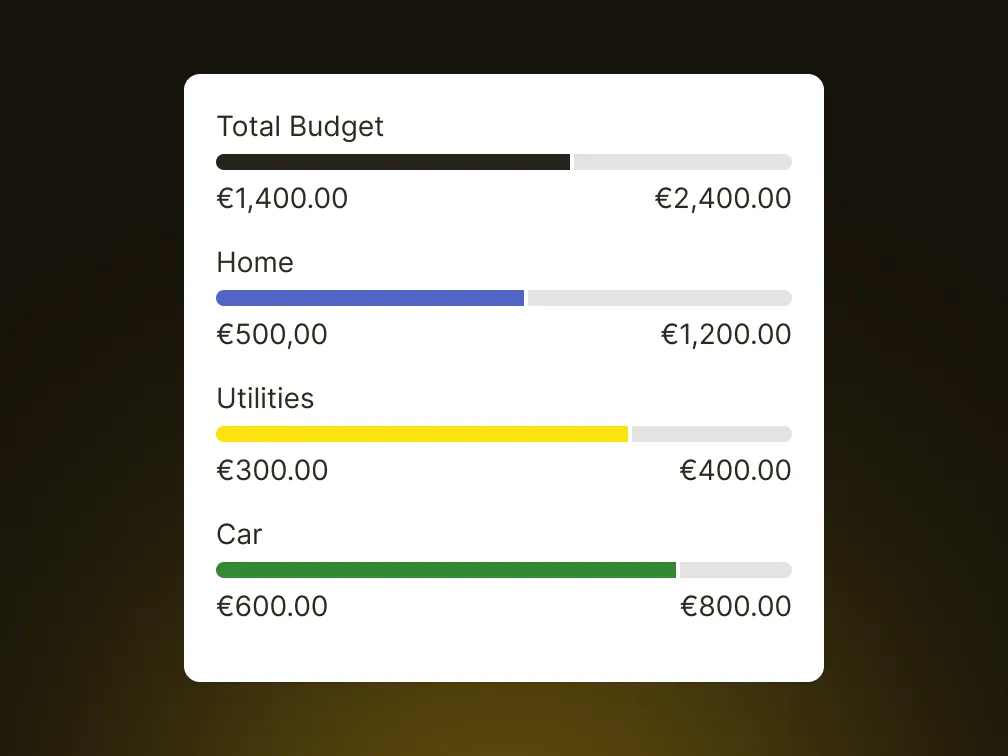

Easy, Clear Categorization

Customize and budget your expense categories so it's easy to see where your money is going at a glance.

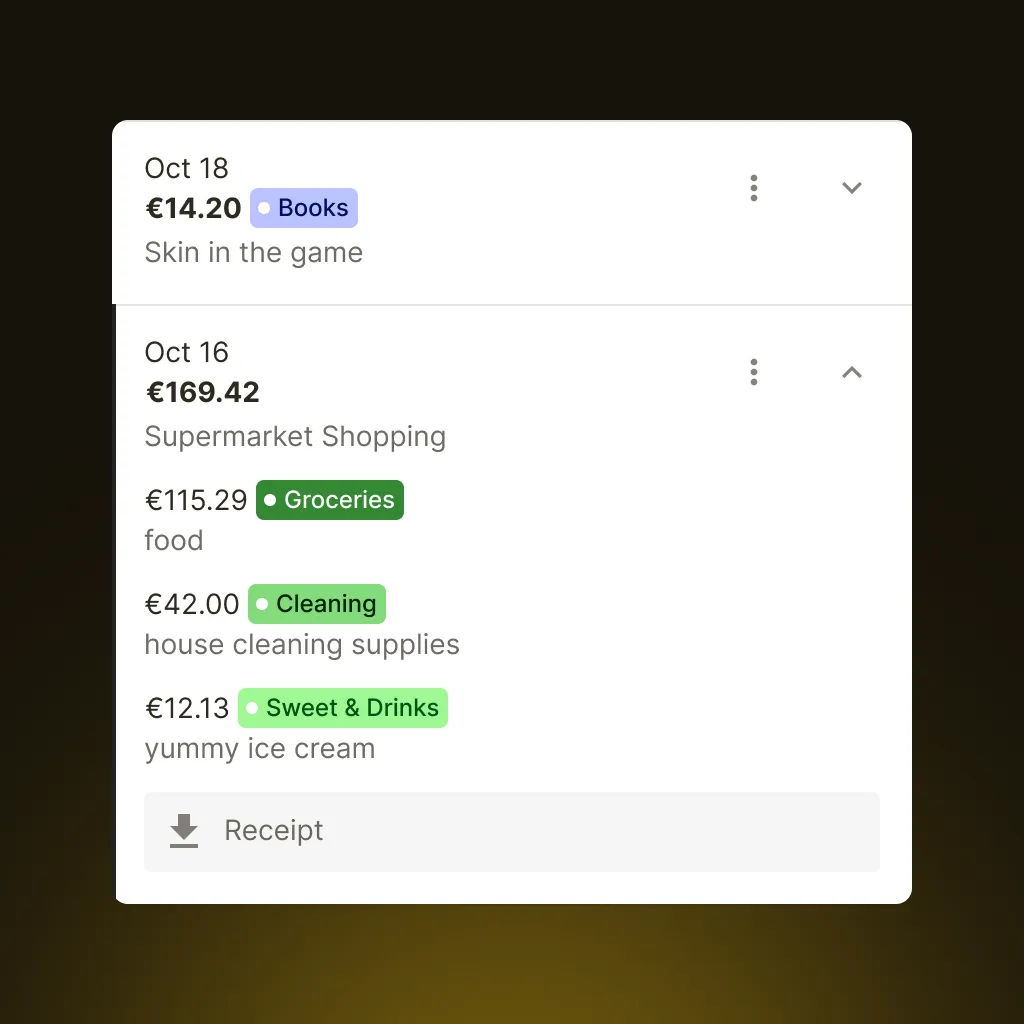

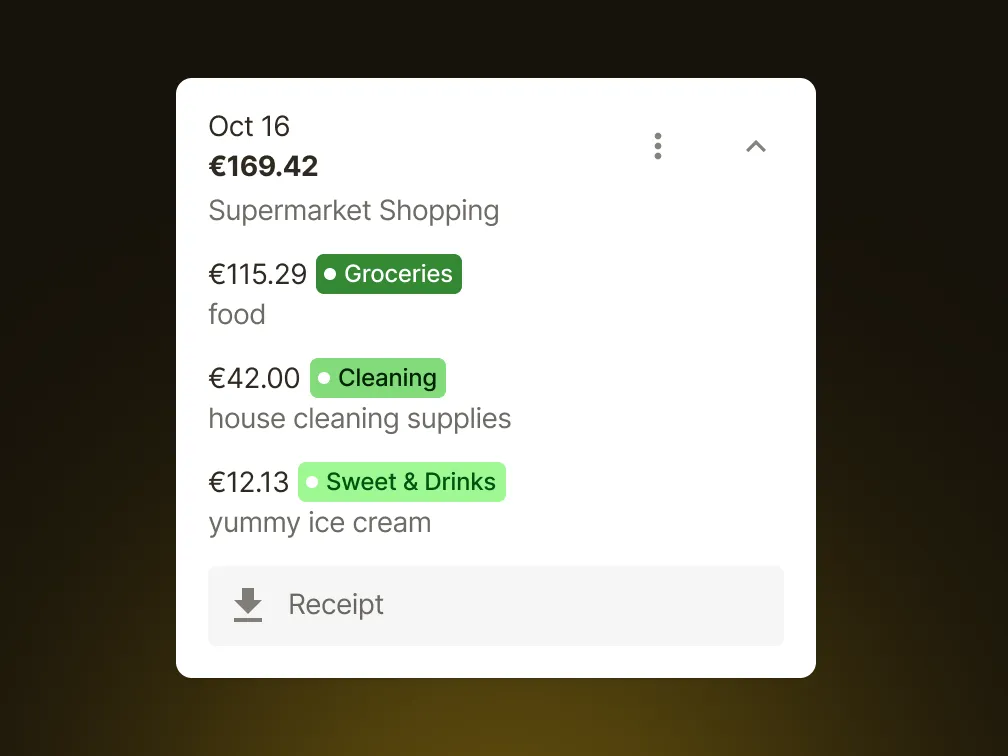

Multi-category Expenses

When you do your groceries shopping, properly categorising and budgeting your expenses into multiple categories is key.

Transactions

Incomes

Incomes & Recurring Incomes

Define one-time occassional incomes or recurring incomes with configurable amount and frequency.

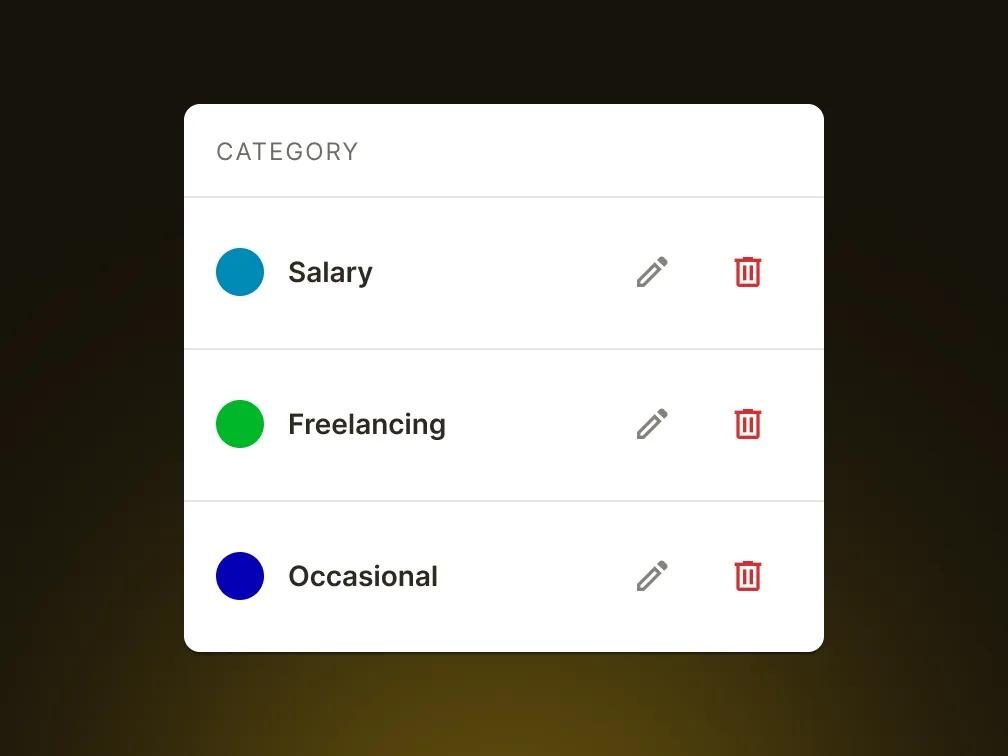

Custom Categories

Categorize your incomes by category and follow their evolution in the advanced reports available.

Transactions

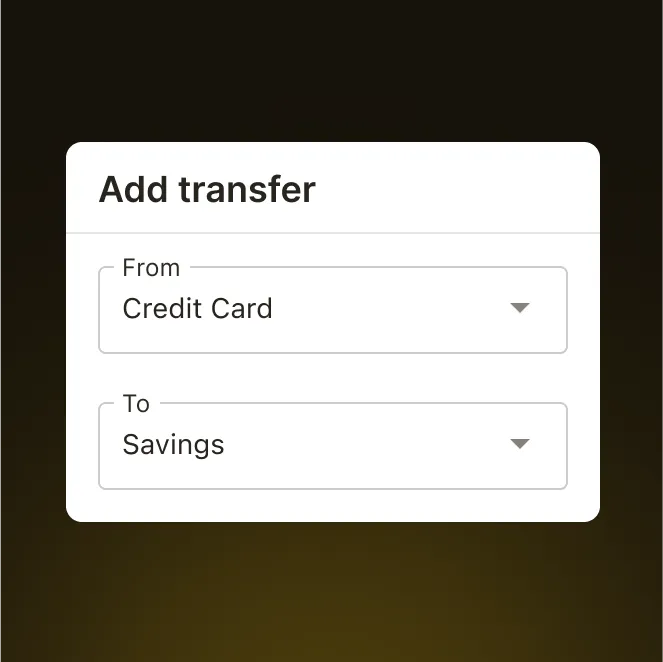

Accounts & Transfers

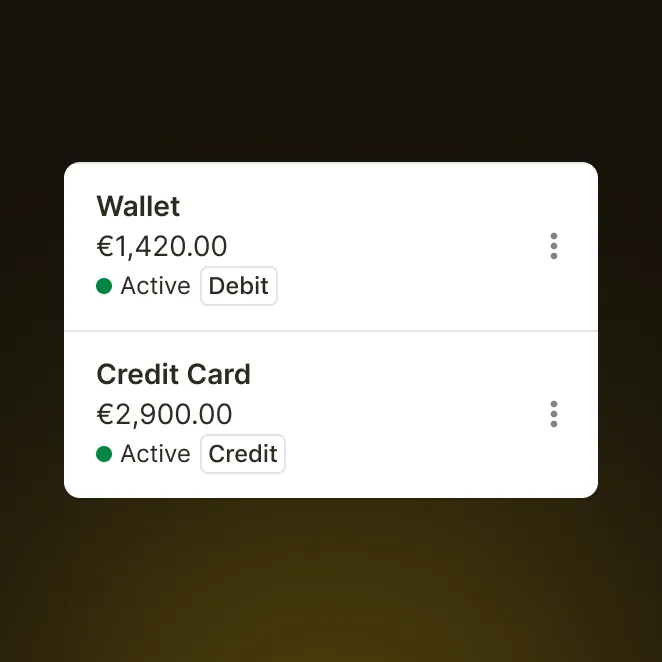

Define your own accounts

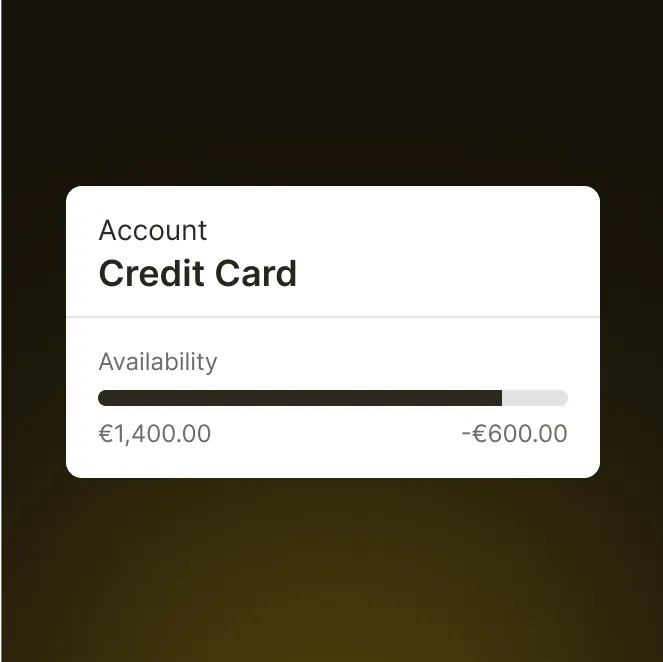

Overdraft accounts

Transfers

Transactions

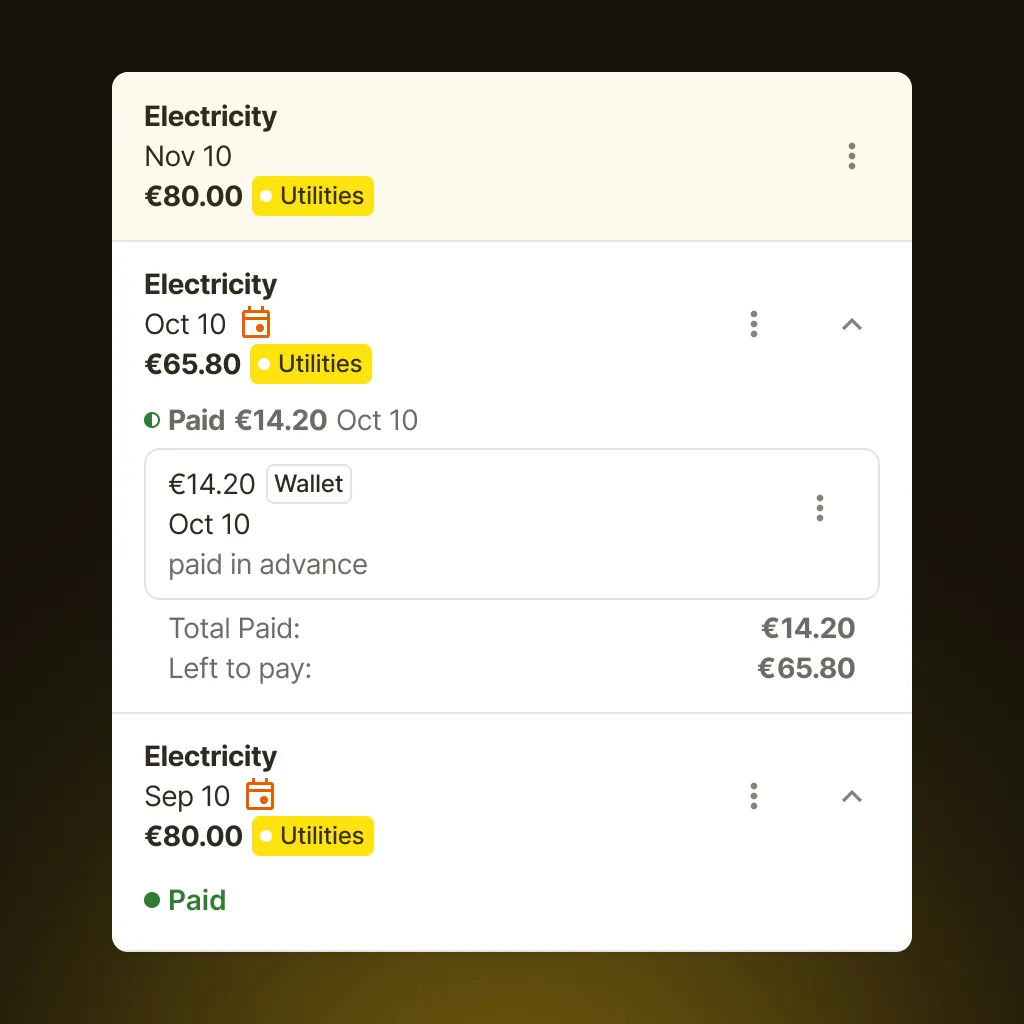

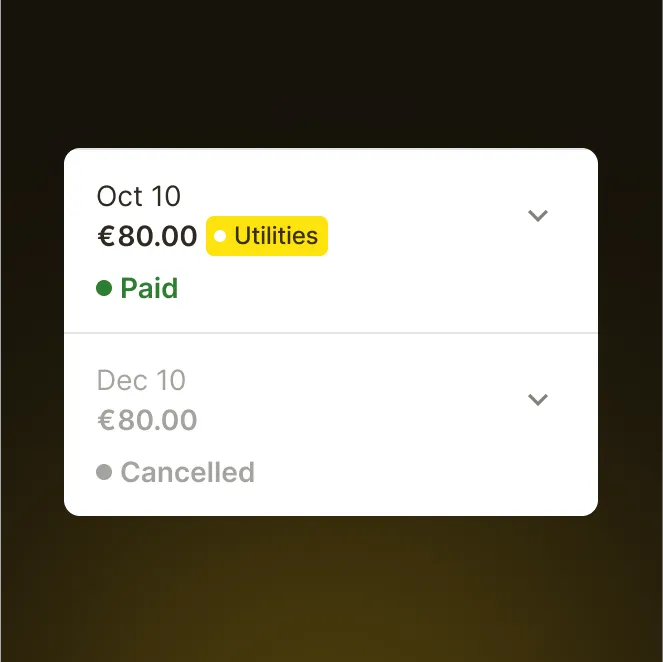

Bills

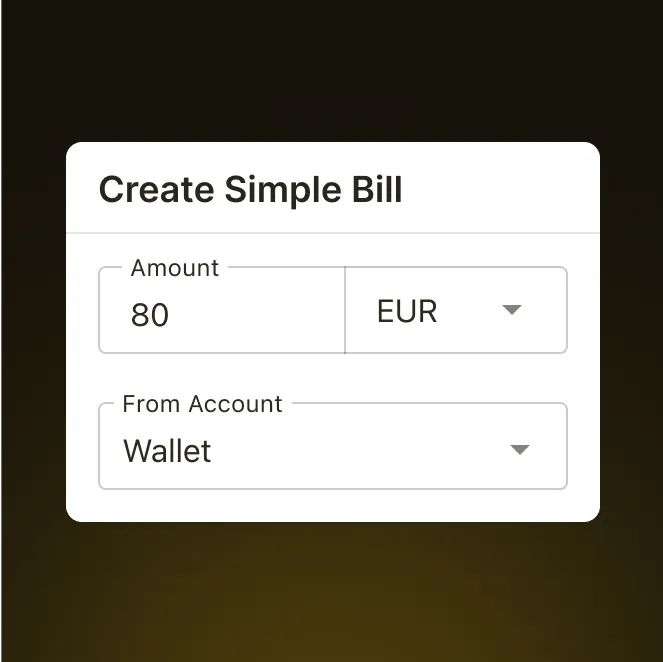

Manage Your Bills

Define your recurring bills and never miss a payment again. You can have recurrences be a fixed amount and confirmed automatically or a variable amount that you can confirm manually.

Add one or multiple payments to a bill, which will show up as expenses in the reports.

Recurring Bill History

One-time simple bills

Option to skip recurrence

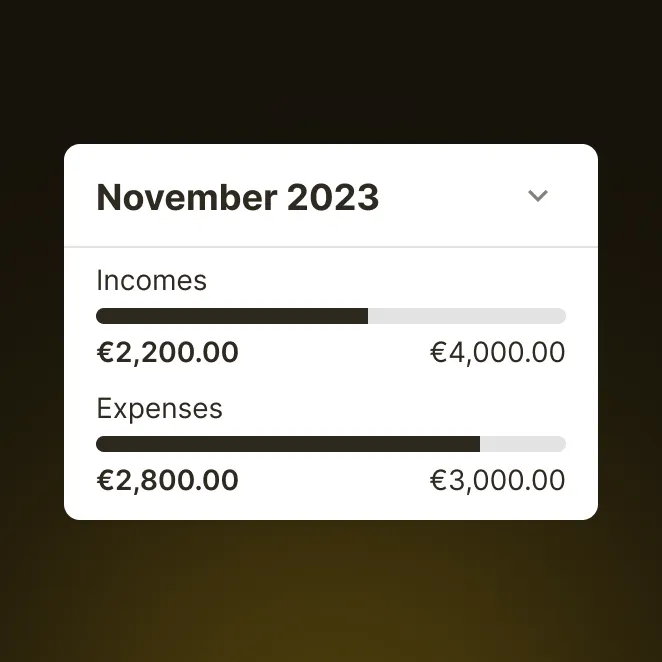

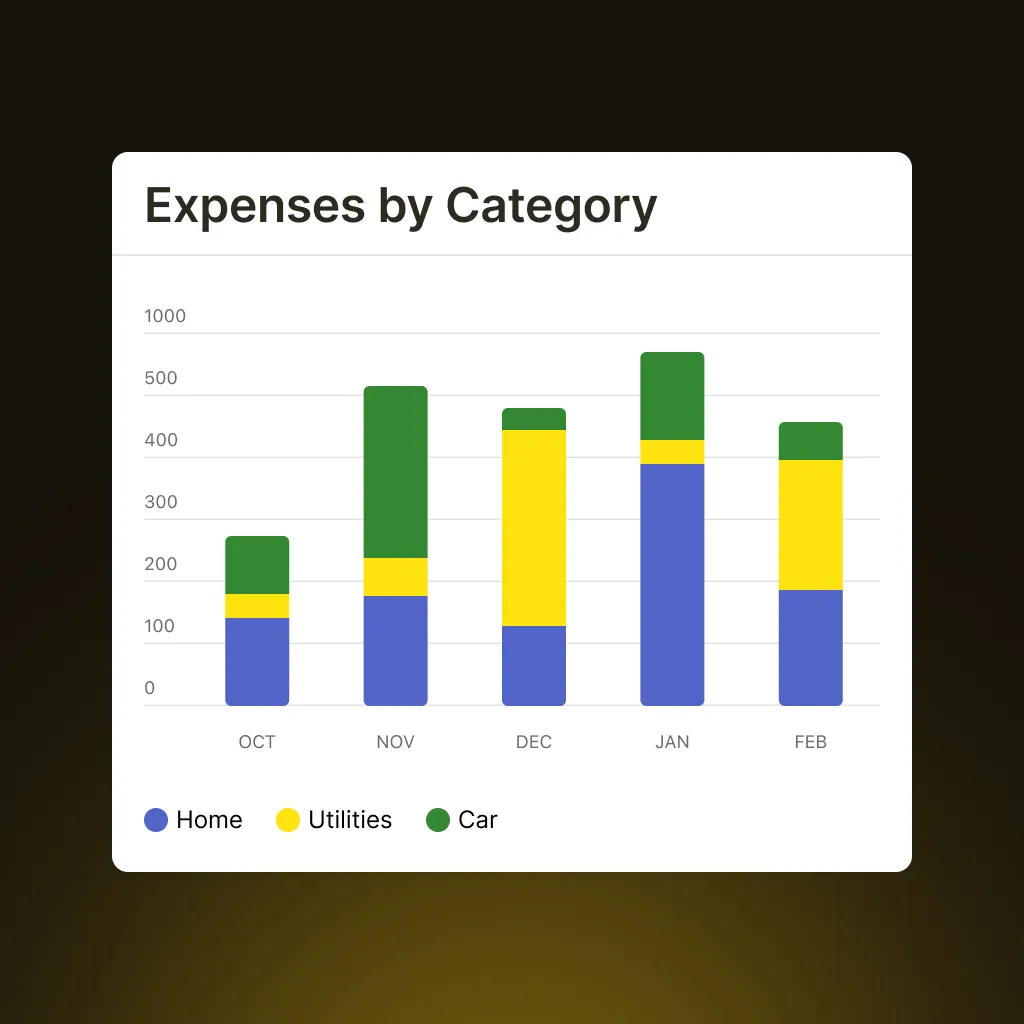

Reports

Deep Insights

Thorough Expense Reports

See a clear breakdown of your expenses by category and their evolution over the past months.

Monitor how your budgets match the reality of your spendings and adjust your habbits accordingly.

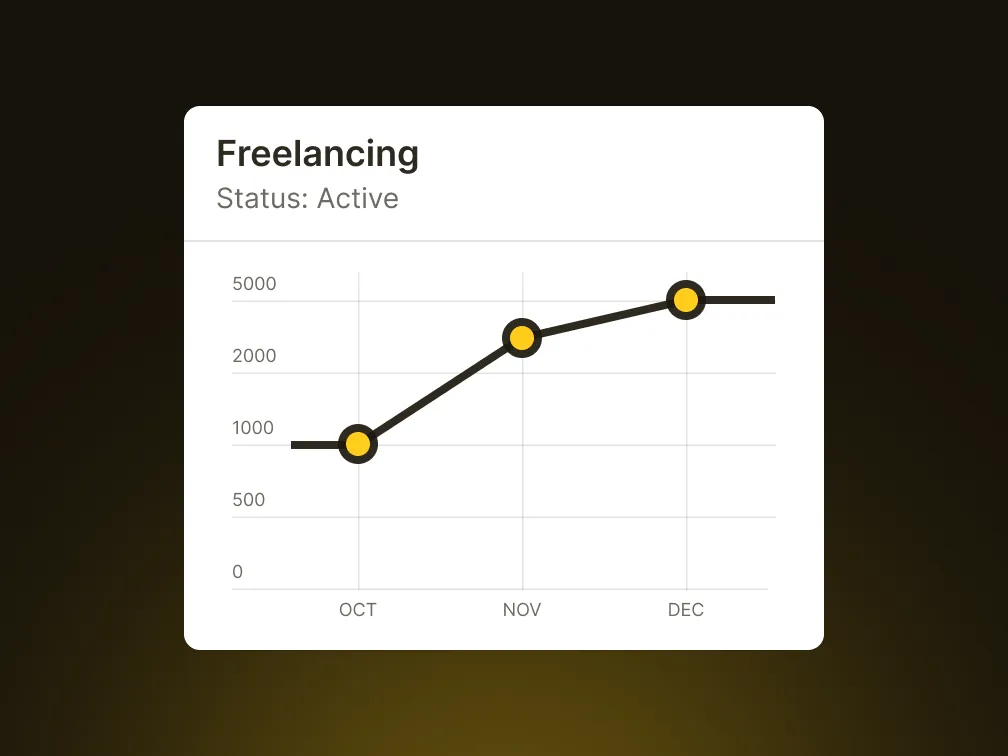

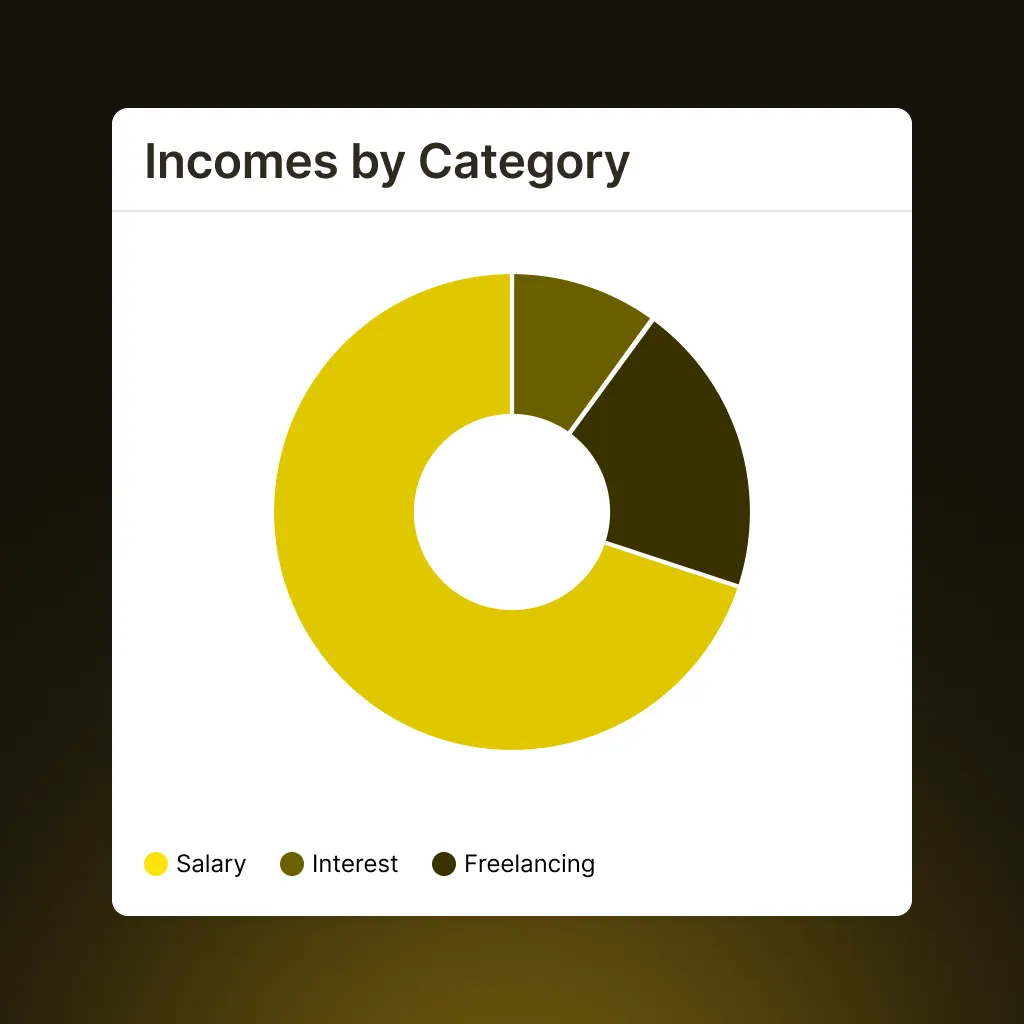

Incomes

See how your incomes evolve over time and how they evolve in purchasing power over time.

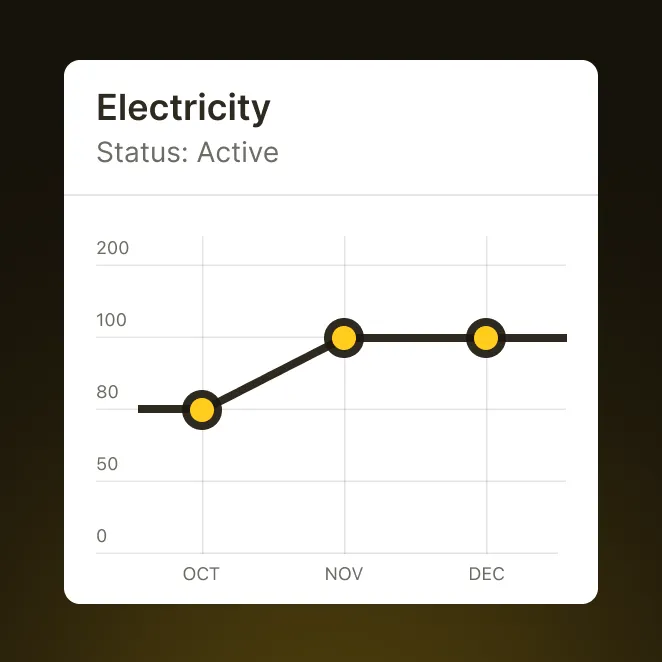

Recurring Reports

For recurring incomes and expenses see how their value evolved over time.

Custom Fiscal Period

Change the first day of the month so you can have custom reporting period.

Reports By Tags

Tag your transactions and get detailed reports broken up by tags.

Purchasing Power

See how your income evolved over time compared to various other indicators.

Monthly Report

Get a monthly report in your inbox so you can see how you did last month and keep a record of your finances.

Bank Sync

Import Your Bank Transactions

Import Your Statement

Download a CSV file from your bank and upload it to CashControl

Define Format

First time, you'll have to define a mapping for your format.

Execute Import

Import bank transactions and get a list of pending transactions to confirm.

Confirm Transactions

Match your pending transactions to existing transactions or add as new.

Users

For Your Entire Family

A Family Task

Get your entire family on board and manage your finances together.

Invite them to join with their own CashControl user and add transactions to your joint account.

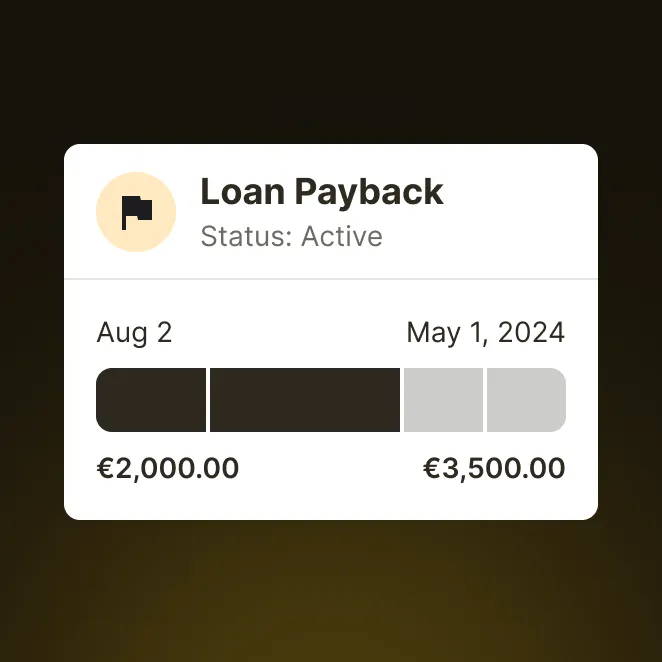

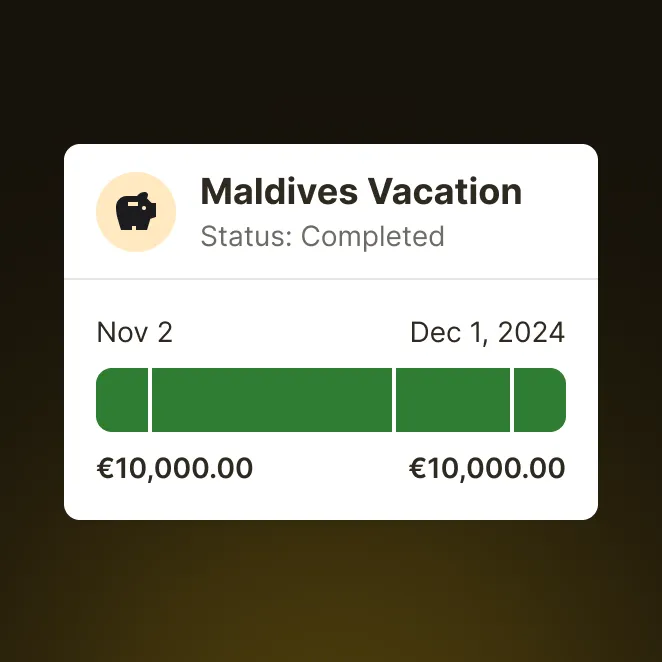

Savings

Goals, Piggybanks and Forecasts

Goals for Loans and Accounts

Piggybanks

Forecasts